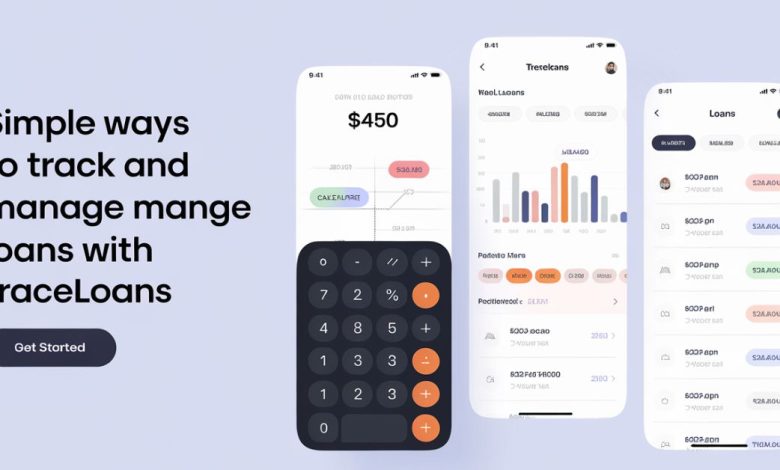

Simple Ways to Track and Manage Loans with TraceLoans

Introduction

Managing loans is often complex, but TraceLoans give clients a perfect platform through which they can easily manage it. Flexible and Simple to Use: Ever experienced the hassle of organizing many loans? Regardless of whether you are dealing with personal loans, business loans, or student loans it’s all tracked on TraceLoans. This is your convenient tool that helps you manage loan efficiently.

Fed up with keeping a tab on loan payments or running from one lender to the other? That’s where TraceLoans come handy. Get total control over your financial situation with little work required on your part.

By making use of TraceLoans one can get all the details of due dates, the balance remaining and payment schedules in one place. It is evident that this platform has a way of notifying the client in actual time so as to enable him or her to meet set obligations. Regardless of whether you need a short-term loan or a loan on which you will slowly pay the amount back, you can be sure that with TraceLoans you will always pay on time.

Take Control of Loan Payments with TraceLoans

This best company, TraceLoans offers easy ways on how the people can manage their loans through dashboarding. They sum up all your loans paying so that you have an immaculate view of your repayments plan. Say goodbye to having to input your username and password to various lender’s websites. In just one place, you are also able to quickly access due dates, balances that are yet to be paid and payments that are upcoming. This not only takes time but also relieves the burden of having to balance between different kinds of loans.

Monitor Your Loan Status in Real-Time

One of the key benefits of TraceLoans is its real-time updates. The platform continuously syncs with your lenders, ensuring that any changes in your loan balance, interest rates, or payment dates are reflected immediately. This means no more surprises—whether an interest rate changes or a new payment is due, TraceLoans keeps you informed. With this feature, staying ahead of your loan commitments has never been easier.

Customized Alerts to Never Miss a Payment

This is very costly for your credit score since it shows up as a delinquent payment by the due date and you will have to pay for the fees, besides. At this stage, the risk is removed by using targeted notifications of TraceLoans. You can receive real-time alerts on forthcoming due dates, overdue payments, or changing of the loans’ packages or conditions. These notifications are received by mail, message or through an app and they help remind you of your money commitments. It was also a great idea that instead of keeping users ignorant of their payments due, TraceLoans sends them notifications so that they do not receive penalties and have a good credit score.

Simplify Loan Management with a User-Friendly Interface

However, you do not need to worry about that because TraceLoans has an interface that makes loan management easy even for a technically less inclined person. Focusing on simplicity and clear organization, the functionality of the platform allows even a child to navigate it. You can easily view loan details, payments, and loan history of the payments made in the past. Convenient both for computer and smartphone users, the interface of TraceLoans allows people of different levels of experience to have a seamless loan experience.

Streamline Multiple Loans in One Platform

Many people juggle different types of loans, from mortgages to personal loans to student debt. TraceLoans consolidates all your loans in one convenient platform. No more switching between apps, websites, or bank accounts. The tool’s ability to streamline multiple loans into one cohesive view means you can focus on repaying without feeling overwhelmed. It’s the ultimate tool for anyone seeking financial clarity and control.

FAQ’s

What is TraceLoans?

TraceLoans is an online platform that helps users track and manage multiple loans in one place.

Can TraceLoans handle different types of loans?

Yes, TraceLoans can manage personal, business, mortgage, and student loans, among others.

Does TraceLoans send payment reminders?

Yes, it offers customized alerts to notify you of upcoming payment deadlines.

Is TraceLoans secure to use?

Absolutely. TraceLoans uses encryption to ensure all your financial data is secure.

Can I access TraceLoans on my phone?

Yes, TraceLoans has a mobile-friendly version, allowing easy access on any device.

Conclusion

Therefore, being a one-stop-loan solution platform, anyone interested in proper loan management should consider using TraceLoans. It makes loan tracking easier, provides updated information, and alert options so that users can easily avoid being charges for being late and keeping their financial situation in check. Regardless of your status – a multi-loan owner or just one with a desire to become less stressed about this issue, TraceLoans will be useful. Start improving your financial situation right now with TraceLoans – choose the direction of development more optimistic.